Yo, diving into the world of asset allocation, we’re about to drop some knowledge that’ll have you investing like a boss. From understanding different assets to strategic approaches, buckle up for a wild ride through the investment game.

Get ready to level up your investment game as we break down the key concepts and strategies behind asset allocation.

Importance of Asset Allocation

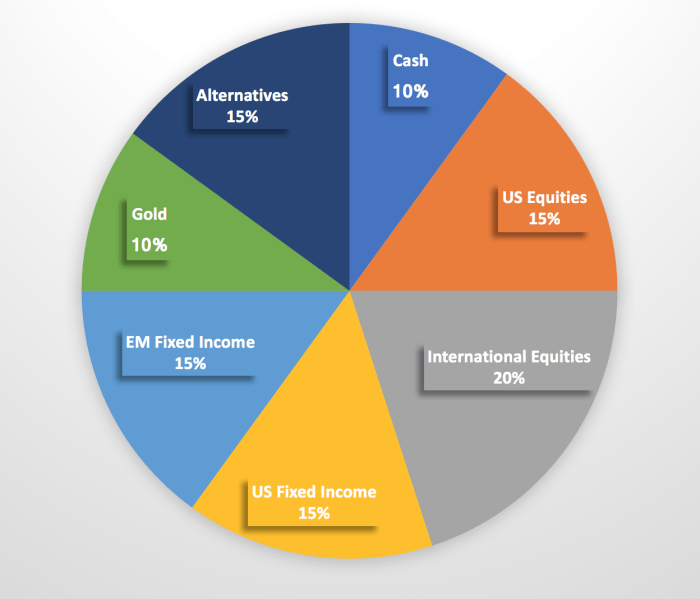

Asset allocation is a key strategy in investment that involves spreading your money across different types of assets to manage risk and optimize returns. By diversifying your portfolio, you can reduce the impact of market fluctuations on your overall investment.

Types of Assets for Allocation

- Stocks: Ownership in a company, offering potential for high returns but also higher risk.

- Bonds: Debt securities issued by governments or corporations, providing steady income but lower returns.

- Real Estate: Property investments that can appreciate over time and generate rental income.

- Commodities: Physical goods like gold, oil, or agricultural products that can serve as a hedge against inflation.

Diversifying through asset allocation can help protect your investments from the volatility of any single asset class.

Benefits of Diversification, Asset allocation

- Reduced Risk: Spreading investments across different assets lowers the impact of a decline in any one asset.

- Enhanced Returns: By including assets with varying growth potentials, you can potentially increase overall returns.

- Stable Income: Allocation to income-producing assets can provide a steady cash flow regardless of market conditions.

- Inflation Protection: Certain assets like real estate and commodities can act as a hedge against inflation, preserving the value of your investments.

Strategies for Asset Allocation

When it comes to managing your investments, having a solid asset allocation strategy is key. Different approaches can be taken to allocate your assets effectively, each with its own set of pros and cons. Let’s dive into the various strategies for asset allocation.

Passive vs. Active Asset Allocation

Passive asset allocation involves setting a predetermined asset allocation and sticking to it without making frequent changes. This strategy aims to minimize costs and is based on the belief that markets are efficient over the long term. On the other hand, active asset allocation involves making frequent adjustments to your asset allocation based on market conditions and economic outlook. This strategy aims to outperform the market by taking advantage of short-term opportunities.

Dynamic Asset Allocation Methods

Dynamic asset allocation methods involve adjusting your asset allocation based on changing market conditions. This approach allows investors to capitalize on market trends and adjust their portfolios accordingly. One common method is tactical asset allocation, where investors shift their allocations based on short-term market movements. Another method is strategic asset allocation, where investors adjust their allocations based on long-term economic trends and market outlook.

Factors Influencing Asset Allocation

When it comes to making decisions about asset allocation, there are several key factors that come into play. These factors can greatly influence the overall investment strategy and portfolio composition.

Risk Tolerance

Risk tolerance plays a crucial role in determining asset allocation. It refers to an individual’s willingness and ability to endure fluctuations in the value of their investments. Those with a higher risk tolerance may be more inclined to allocate a larger portion of their portfolio to higher-risk, higher-return investments such as stocks. On the other hand, investors with a lower risk tolerance may opt for a more conservative approach, focusing on lower-risk assets like bonds or cash equivalents.

Investment Goals

Another important factor that influences asset allocation decisions is investment goals. Different investors have different objectives when it comes to investing, whether it’s saving for retirement, funding a child’s education, or simply growing wealth over time. These goals can impact the time horizon for investments, liquidity needs, and desired returns. For instance, a long-term investor with a goal of retirement savings may choose a more aggressive asset allocation strategy to pursue higher returns over time, while a short-term investor with immediate liquidity needs may opt for a more conservative approach to protect capital.

Asset Allocation Models

Asset allocation models are crucial for investors looking to optimize their portfolios and manage risk effectively. These models provide a framework for determining the ideal mix of assets based on an individual’s risk tolerance, investment goals, and time horizon.

Modern Portfolio Theory

Modern Portfolio Theory, developed by Harry Markowitz, emphasizes diversification to reduce risk without sacrificing returns. This model suggests that by holding a mix of assets that are not perfectly correlated, an investor can achieve a more efficient portfolio.

- Investors can use the efficient frontier to identify the optimal portfolio that offers the highest return for a given level of risk.

- By combining assets with different risk profiles, investors can achieve a more stable portfolio that can weather market fluctuations.

Asset allocation models like Modern Portfolio Theory provide a quantitative framework for making investment decisions based on risk and return.

Capital Asset Pricing Model (CAPM)

The Capital Asset Pricing Model (CAPM) is a widely-used model that helps investors determine the expected return on an asset based on its risk relative to the market. This model considers the risk-free rate, beta (systematic risk), and the market risk premium to calculate the expected return on an asset.

- Investors can use CAPM to assess whether an asset is priced correctly based on its risk and return potential.

- CAPM is a valuable tool for asset allocation as it helps investors understand how to adjust their portfolios to achieve the desired level of risk and return.

CAPM provides a systematic way to evaluate the risk and return characteristics of individual assets within a portfolio.

Efficient Frontier

The Efficient Frontier represents the set of optimal portfolios that offer the highest expected return for a given level of risk. This concept helps investors visualize the trade-off between risk and return and identify the portfolio that maximizes returns while minimizing risk.

- By plotting various asset allocations on the Efficient Frontier, investors can determine the most efficient portfolio that suits their investment objectives.

- The Efficient Frontier is a key concept in asset allocation modeling as it helps investors make informed decisions about portfolio construction.

The Efficient Frontier guides investors in selecting the optimal mix of assets to achieve their desired risk-return profile.