Financial planning for retirement takes center stage in the quest for a secure future. Get ready to dive into the world of savvy choices and smart strategies, where your financial well-being is the ultimate goal.

Let’s explore the key aspects of financial planning for retirement and how they can pave the way for a stress-free and fulfilling future ahead.

Overview of Financial Planning for Retirement

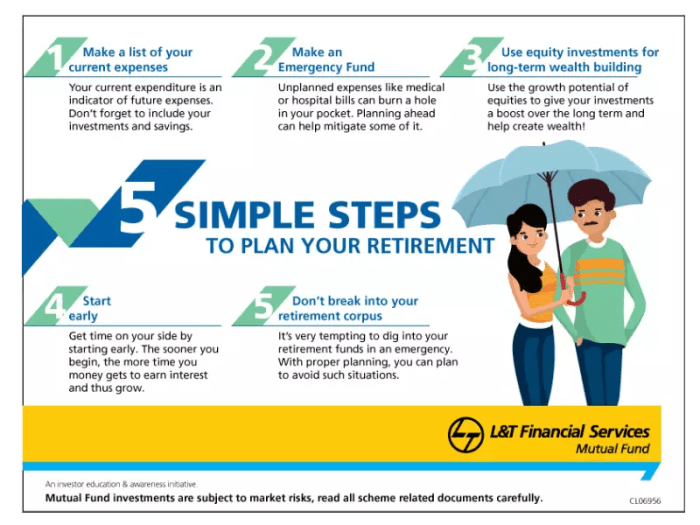

Financial planning for retirement involves creating a strategy to ensure financial security during your retirement years. It includes setting financial goals, saving and investing money, and managing assets to achieve those goals.Early retirement planning is crucial because it allows you to take advantage of compounding interest and time to build a substantial nest egg. Starting early gives you more time to save and invest, increasing the likelihood of meeting your retirement goals.

Key Components of a Comprehensive Retirement Plan

- Setting Retirement Goals: Determine how much money you will need in retirement and what lifestyle you want to maintain.

- Creating a Budget: Develop a budget that includes saving for retirement, living expenses, and other financial goals.

- Investing for Retirement: Choose appropriate investment vehicles based on your risk tolerance and time horizon.

- Managing Debt: Pay off high-interest debt to free up more money for retirement savings.

- Insurance Planning: Ensure you have adequate health, life, and long-term care insurance coverage.

- Estate Planning: Develop a plan for distributing your assets and minimizing taxes upon your passing.

Setting Retirement Goals

Setting specific retirement goals is essential for individuals to have a clear roadmap towards financial stability during their retirement years. By establishing these goals, individuals can better plan, save, and invest to achieve the lifestyle they desire in their later years.

Short-term and Long-term Retirement Goals

- Short-term goals: These are typically goals that can be achieved within the next 1-5 years. Examples include building an emergency fund, paying off high-interest debt, or setting aside a specific amount of money for retirement savings annually.

- Long-term goals: These are goals that individuals aim to achieve over a longer period, usually 10 years or more. Examples include reaching a certain retirement savings target, owning a home outright, or being able to travel extensively during retirement.

Importance of Clear Goals in Retirement Planning

Setting clear retirement goals provides individuals with a sense of direction and purpose in their financial planning journey. It helps them prioritize their spending, savings, and investment decisions to align with their overarching objectives. With specific goals in mind, individuals can track their progress, make adjustments as needed, and stay motivated to stay on course towards a secure retirement.

Retirement Savings Strategies

When it comes to preparing for retirement, having a solid savings strategy is crucial. Let’s dive into different approaches you can take to secure your financial future.

Employer-Sponsored Plans

Employer-sponsored retirement plans, such as 401(k)s, are a popular way to save for retirement. These plans allow you to contribute a portion of your salary to a tax-advantaged account, often with employer matching contributions. Take advantage of these plans as they offer a convenient way to save for the future while reducing your taxable income.

IRAs (Individual Retirement Accounts)

IRAs are another valuable tool for retirement savings. These accounts allow you to save for retirement with tax advantages, either through traditional IRAs where contributions are tax-deductible, or Roth IRAs where withdrawals in retirement are tax-free. Consider opening an IRA to supplement your employer-sponsored plan and increase your savings potential.

Traditional vs. Roth Retirement Accounts

Understanding the difference between traditional and Roth retirement accounts is essential. Traditional accounts offer immediate tax benefits through tax-deductible contributions, but withdrawals in retirement are taxed. On the other hand, Roth accounts provide tax-free withdrawals in retirement, making them a valuable option if you expect to be in a higher tax bracket when you retire.

Diversification in Retirement Savings

Diversification is key to a successful retirement savings strategy. By spreading your investments across different asset classes, you can reduce risk and improve your chances of long-term growth. Consider diversifying your retirement savings through a mix of stocks, bonds, and other investment vehicles to safeguard your financial future.

Investment Planning for Retirement

Investment planning is a crucial aspect of building a solid retirement portfolio. By strategically investing your savings, you can potentially grow your wealth over time and ensure a comfortable retirement.

The Importance of Investment Planning in a Retirement Portfolio

Investment planning plays a vital role in a retirement portfolio as it helps individuals generate the necessary returns to sustain their lifestyle after they stop working. By investing in a diverse range of assets, individuals can mitigate risks and maximize returns over the long term.

Explain the Role of Risk Tolerance in Investment Decisions for Retirement

Risk tolerance refers to an individual’s ability and willingness to endure fluctuations in the value of their investments. It is crucial to consider risk tolerance when making investment decisions for retirement as it determines the mix of assets in a portfolio. Those with a higher risk tolerance may opt for more aggressive investments, while those with a lower risk tolerance may choose more conservative options.

Examples of Investment Options Suitable for Retirement Planning

- 1. Stocks: Investing in individual stocks or stock mutual funds can provide the potential for high returns over the long term, although they come with higher volatility.

- 2. Bonds: Bonds are considered safer investments than stocks and can provide a steady income stream through interest payments.

- 3. Real Estate: Real estate investments, such as rental properties or real estate investment trusts (REITs), can offer both income and potential for capital appreciation.

- 4. Retirement Accounts: Contributing to retirement accounts like 401(k)s or IRAs can provide tax advantages and help individuals save for retirement in a disciplined manner.

Social Security and Other Income Sources

When planning for retirement, it’s crucial to consider various sources of income, including Social Security benefits and other potential streams of income.

Social Security Benefits

Social Security benefits play a significant role in retirement planning, providing a steady source of income for retirees. The amount you receive will depend on factors such as your earnings history and when you choose to start receiving benefits.

- It’s important to understand how your Social Security benefits will impact your overall financial plan for retirement.

- Consider factors such as the age at which you plan to start receiving benefits and how they will complement other sources of income.

- Optimizing your Social Security benefits can help maximize your retirement income and provide financial stability in your later years.

Other Income Sources

In addition to Social Security benefits, retirees may have access to other income sources such as pensions or annuities.

- Pensions provide a regular payment based on your years of service with an employer, offering a reliable income stream during retirement.

- Annuities are financial products that can provide guaranteed income for life, offering a way to supplement your retirement savings.

- Exploring different income sources can help diversify your retirement income and reduce reliance on any single source.

Healthcare and Long-Term Care Considerations

When planning for retirement, it’s essential to consider healthcare costs as a significant factor in your financial strategy. Healthcare expenses can increase as you age, and having a plan in place can help mitigate the impact on your retirement savings.Long-term care insurance plays a crucial role in retirement planning by providing coverage for services like nursing home care, assisted living, and in-home care.

It can help protect your assets and ensure you receive the care you need without draining your retirement funds.

Managing Healthcare Expenses During Retirement, Financial planning for retirement

- Consider setting aside a separate healthcare fund to cover medical expenses not covered by insurance.

- Review your health insurance options, including Medicare and supplemental insurance, to ensure you have adequate coverage.

- Explore options for long-term care insurance to protect your assets and provide for potential future needs.

- Stay proactive about preventive care and wellness to help reduce the risk of costly medical issues in the future.

- Consult with a financial advisor to create a comprehensive plan that includes healthcare expenses in your retirement budget.

Estate Planning and Legacy Considerations: Financial Planning For Retirement

Estate planning plays a crucial role in retirement preparation as it involves organizing and managing your assets to ensure they are distributed according to your wishes after you pass away. It helps minimize estate taxes and legal complications for your beneficiaries.

Creating a Will and Establishing Powers of Attorney

Creating a will is essential in estate planning as it allows you to specify how your assets should be distributed among your heirs. It also enables you to appoint guardians for minor children and designate an executor to carry out your wishes. Powers of attorney, including financial and healthcare powers, ensure that trusted individuals can make decisions on your behalf if you become incapacitated.

Smooth Transfer of Assets to Beneficiaries

- Designate beneficiaries on retirement accounts and insurance policies to bypass probate.

- Consider setting up trusts to protect assets and control their distribution.

- Regularly review and update your estate plan to reflect life changes and ensure it aligns with your current wishes.

- Consult with legal and financial professionals to create a comprehensive estate plan tailored to your specific needs and goals.