Kicking off with Understanding mutual funds, this guide will take you on a journey through the world of investing in mutual funds, breaking down the concepts in a way that’s easy to grasp and totally rad.

Get ready to dive into the benefits, risks, and everything else you need to know about mutual funds like a true high school hip investor.

What are mutual funds?

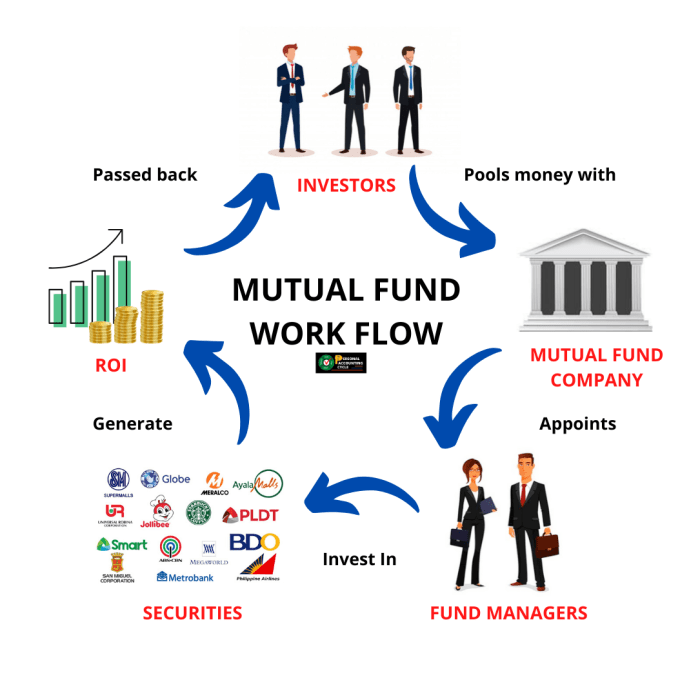

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. These funds are managed by professional portfolio managers who make investment decisions on behalf of the investors.

How do mutual funds work?

When an investor buys shares in a mutual fund, they are essentially buying a piece of the fund’s portfolio. The value of the shares is based on the performance of the underlying securities in the portfolio. Mutual funds can be actively managed, where the portfolio manager makes decisions to buy and sell securities in an attempt to outperform the market, or passively managed, where the fund simply tracks a specific index.

- Mutual funds provide diversification by investing in a wide range of securities, reducing the risk of holding individual stocks or bonds.

- Investors can choose from different types of mutual funds based on their investment goals, risk tolerance, and time horizon. Some common types include equity funds, bond funds, index funds, and balanced funds.

- Investors can buy and sell mutual fund shares at the end of the trading day based on the fund’s net asset value (NAV), which is calculated at the end of each trading day.

Benefits of investing in mutual funds: Understanding Mutual Funds

Investing in mutual funds comes with several advantages that make them a popular choice among investors. One of the key benefits is diversification, which helps spread out risk across a wide range of investments. This can help reduce the impact of market volatility on your overall portfolio. Additionally, mutual funds provide professional management, giving you access to experienced fund managers who make investment decisions on your behalf.

Diversification through mutual funds

- By investing in a mutual fund, you can own a diversified portfolio of stocks, bonds, or other securities without having to purchase each individual security yourself.

- This diversification helps reduce the risk of significant losses from a single investment performing poorly.

- It allows you to benefit from the performance of multiple assets, potentially increasing your chances of positive returns.

Professional management of mutual funds

- Mutual funds are managed by experienced professionals who analyze market trends, conduct research, and make informed investment decisions on behalf of investors.

- These fund managers have the expertise to adjust the fund’s holdings based on market conditions, aiming to maximize returns while managing risk.

- Investors benefit from this professional management without having to actively monitor and manage their investments themselves.

Risks associated with mutual funds

Investing in mutual funds comes with its own set of risks that investors need to be aware of. These risks can impact the performance and returns of the mutual fund investments.

Market Fluctuations, Understanding mutual funds

Market fluctuations play a significant role in affecting the value of mutual funds. When the market goes up or down, the value of the mutual fund also changes accordingly. This can lead to fluctuations in the returns earned by investors.

Specific Risks

- Market Risk: This is the risk that the value of investments in the mutual fund may decrease due to changes in market conditions.

- Interest Rate Risk: Mutual funds that invest in fixed-income securities are exposed to interest rate risk. If interest rates rise, the value of these securities may fall.

- Liquidity Risk: This is the risk that investors may not be able to sell their mutual fund shares quickly enough without affecting the price.

- Credit Risk: Mutual funds that invest in bonds are subject to credit risk, where the issuer of the bond may default on payments.

How to choose the right mutual fund

When it comes to choosing the right mutual fund, there are several factors to consider to ensure that it aligns with your investment goals and risk tolerance. It’s important to do thorough research and analysis before making a decision.

Expense Ratio

- Compare the expense ratios of different mutual funds. Lower expense ratios mean more of your money is being invested rather than going towards fees.

- Look for funds with expense ratios below the industry average to maximize your returns over time.

Performance History

- Review the past performance of the mutual fund over different time periods. While past performance is not indicative of future results, it can give you insights into how the fund has performed in various market conditions.

- Consider funds that have consistently outperformed their benchmarks and peers.

Risk Profile

- Assess the risk profile of the mutual fund and ensure it aligns with your risk tolerance. Different funds have varying levels of risk, so it’s crucial to choose one that matches your comfort level.

- Understand the volatility and potential downside of the fund to make an informed decision.

Investment Objective

- Determine your investment goals and objectives before selecting a mutual fund. Whether you’re looking for growth, income, or a combination of both, there are funds tailored to different objectives.

- Make sure the fund’s investment strategy aligns with your goals to achieve the desired outcomes.

Understanding mutual fund fees

When investing in mutual funds, it’s crucial to understand the various fees associated with them. These fees can significantly impact your investment returns, so it’s essential to know how to minimize them.

Types of fees associated with mutual funds:

- Expense Ratio: This fee covers the operating expenses of the mutual fund and is calculated as a percentage of the fund’s assets.

- Front-end Load: This fee is charged when you purchase shares of the mutual fund and is deducted upfront.

- Back-end Load: This fee is charged when you sell your shares of the mutual fund and is deducted at the time of redemption.

- Management Fee: This fee is paid to the fund manager for managing the investments in the fund.

- Other fees: These can include account fees, transaction fees, and other miscellaneous charges.

How fees impact investment returns:

High fees can eat into your investment returns over time, reducing the overall growth of your portfolio. Even seemingly small fees can have a significant impact on your long-term gains.

Tips on how to minimize fees when investing in mutual funds:

- Look for low-cost index funds or ETFs, which typically have lower expense ratios compared to actively managed funds.

- Avoid funds with high front-end or back-end loads, as these can erode your returns, especially if you plan to hold the fund for a long time.

- Consider investing in no-load funds, which do not charge sales commissions.

- Regularly review your investment portfolio and consider consolidating accounts to reduce account fees.

- Compare fees across different mutual funds and choose ones with competitive fee structures.

Performance evaluation of mutual funds

When assessing the performance of mutual funds, investors need to look at a variety of key metrics to determine how well a fund has performed over time. It’s essential to understand these metrics and interpret historical performance data to make informed investment decisions.

Key Metrics for Evaluating Mutual Fund Performance

- Annualized Returns: This metric shows the average annual return of a mutual fund over a specific period, providing insight into the fund’s performance.

- Expense Ratio: The expense ratio reflects the percentage of a fund’s assets deducted annually to cover operating expenses. Lower expense ratios are generally more favorable for investors.

- Sharpe Ratio: The Sharpe ratio measures a fund’s risk-adjusted return, indicating how well the fund has performed relative to the level of risk taken.

- Standard Deviation: This metric shows the volatility of a fund’s returns over time. Lower standard deviation indicates less volatility.

Interpreting Historical Performance Data

- Compare Against Benchmark: Investors should compare a fund’s performance against a relevant benchmark index to gauge its success in outperforming the market.

- Consider Time Period: It’s crucial to evaluate a fund’s performance over various time periods to understand its consistency and ability to generate returns in different market conditions.

- Look at Fund Manager Tenure: Examining the tenure of a fund manager can provide insights into the fund’s historical performance and the manager’s ability to navigate market cycles.

- Review Fund Objectives: Understanding a fund’s investment objectives and strategies can help investors assess whether the fund has met its goals and maintained a consistent performance track record.