Dive into the world of dividend investing strategies, where savvy investors harness the potential of passive income and long-term wealth growth. From understanding the basics to exploring advanced tactics, this guide will equip you with the knowledge to make informed investment decisions.

Definition of Dividend Investing

Dividend investing is a strategy where investors focus on purchasing stocks from companies that pay out regular dividends to their shareholders. These dividends are a portion of the company’s profits distributed to investors as a form of return on their investment.

Examples of Companies with Dividend-Paying Stocks

- Apple Inc. (AAPL) – Known for consistently increasing dividends over the years.

- Johnson & Johnson (JNJ) – A healthcare giant with a long history of paying dividends.

- Procter & Gamble (PG) – Consumer goods company renowned for its dividend payments.

Benefits of Dividend Investing

- Stable Income: Dividend payments can provide a steady source of income for investors.

- Compound Growth: Reinvesting dividends can accelerate wealth accumulation through compounding.

- Lower Risk: Companies that pay dividends tend to be more established and financially stable.

Dividend Investing as a Source of Passive Income

Dividend investing can be a reliable source of passive income as investors receive regular payments without actively trading or selling their investments. By choosing companies with a history of consistent dividend payouts, investors can build a portfolio that generates income over time.

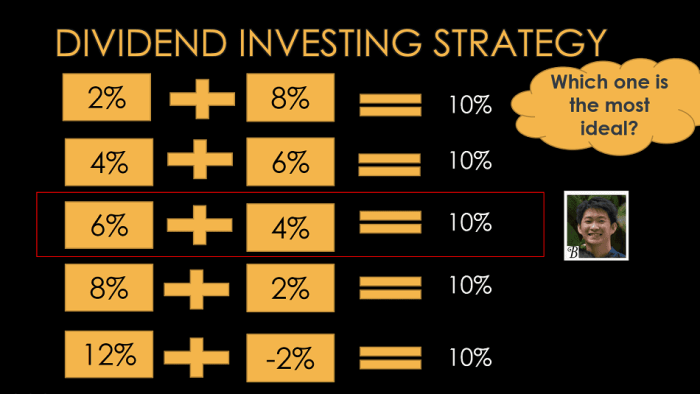

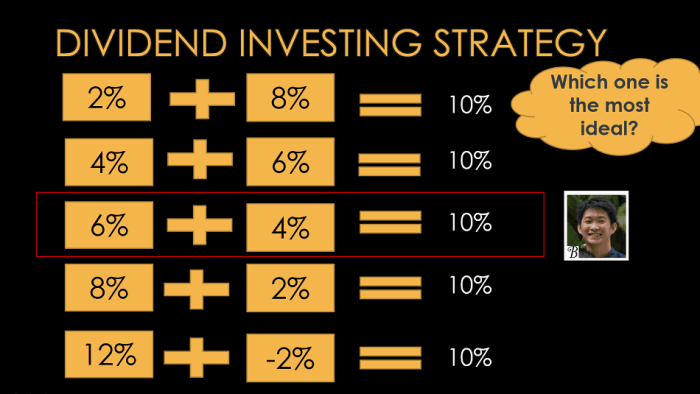

Types of Dividend Investing Strategies

When it comes to dividend investing, there are several strategies that investors can utilize to achieve their financial goals. Each strategy has its own unique characteristics, benefits, and risks. Let’s explore some of the most common types of dividend investing strategies.

Dividend Growth Investing

Dividend growth investing focuses on investing in companies that have a track record of consistently increasing their dividend payouts over time. These companies typically have strong financial health and stable earnings growth. Investors who follow this strategy aim to benefit from both the dividend income and the potential for capital appreciation.

- Characteristics:

- Focus on companies with a history of increasing dividends

- Long-term investment horizon

- Emphasis on fundamental analysis

- Examples: Johnson & Johnson, Coca-Cola, Procter & Gamble

- Risk Factors:

- Market volatility can impact stock prices

- Companies may face challenges in sustaining dividend growth

High Dividend Yield Investing

High dividend yield investing involves selecting stocks that offer high dividend yields relative to their stock price. These companies typically distribute a larger portion of their earnings to shareholders in the form of dividends. Investors who follow this strategy prioritize current income over potential capital appreciation.

- Characteristics:

- Focus on companies with high dividend yields

- Short to medium-term investment horizon

- Income generation is the primary goal

- Examples: AT&T, Exxon Mobil, Verizon

- Risk Factors:

- High dividend yields may indicate financial distress

- Stock price volatility can impact overall returns

Factors to Consider When Choosing Dividend Stocks

When selecting dividend-paying stocks, there are several key factors to consider that can impact your investment decisions. Understanding how economic conditions, a company’s dividend history, financial stability, and the importance of diversification play a crucial role in building a successful dividend investment portfolio.

Economic Conditions Impact

Economic conditions such as inflation, interest rates, and overall market performance can have a significant impact on dividend stocks. High inflation rates or economic downturns may lead to companies cutting dividends to conserve cash. On the other hand, a stable economy with low inflation rates can provide a favorable environment for dividend-paying stocks to thrive.

Company’s Dividend History and Financial Stability

Analyzing a company’s dividend history is essential to ensure they have a consistent track record of paying dividends. Look for companies with a history of increasing or maintaining dividends even during challenging economic times. Additionally, assess the company’s financial stability by examining key financial ratios such as debt levels, cash flow, and profitability.

Importance of Diversification

Diversification is crucial in a dividend investment portfolio to mitigate risk and protect against volatility. By investing in a variety of dividend-paying stocks across different sectors and industries, you can spread out your risk and potentially increase your chances of earning a stable income from dividends. Avoid putting all your money into just a few stocks, as this can expose you to significant losses if one company underperforms.

Reinvesting Dividends for Compound Growth

When it comes to dividend investing, reinvesting dividends can play a crucial role in achieving compound growth over time. By reinvesting the dividends received from your investments back into the same stocks or funds, you can benefit from the power of compounding.

Advantages of Reinvesting Dividends

- Accelerated Growth: Reinvesting dividends allows you to purchase additional shares, leading to a larger investment base that generates even more dividends in the future.

- Compound Effect: The reinvested dividends start generating their own dividends, compounding your returns exponentially over time.

- Cost Averaging: Reinvesting dividends can help you buy more shares when prices are lower, averaging out your cost per share over time.

Impact of Reinvesting Dividends – Case Studies

For example, let’s consider two investors who both invest $10,000 in a dividend-paying stock. Investor A chooses to reinvest all dividends received, while Investor B opts to cash out the dividends. After 10 years, Investor A’s investment would have grown significantly more due to the power of compounding.

Strategies for Reinvesting Dividends Effectively

- DRIP (Dividend Reinvestment Plan): Enroll in a DRIP offered by the company or through your broker to automatically reinvest dividends in more shares.

- Rebalance Regularly: Periodically review your portfolio and rebalance to ensure your investments align with your goals and risk tolerance.

- Diversify: Consider reinvesting dividends across different sectors or asset classes to spread risk and maximize growth potential.